Blog

Should you invest in Thematic or Sectoral Funds?

What are Thematic or Sectoral Funds?

Sectoral funds as the name suggests are mutual fund schemes that invest pre-dominantly in companies belonging to a single sector. There can be multiple types of sectoral funds depending on in industry in which the fund invests. Eg- Pharma Fund, Banking & Finance Fund, Energy, Metals, Technology, Infrastructure.

Thematic Funds are generally broader in scope as compared to sectoral funds and can cover multiple sectors. Fe examples of themes could be technology, digital, export oriented or ESG (Environmental. Social & Governance). Now these themes are broad based and so an Export oriented fund can easily invest in a range of sectors as long as the companies adhere to the ESG criteria. Some examples of ESG theme would be Rural Themes, Consumption Themes, Digital & Technology Themes. Some of these digital themes could also be played via the Fund of Fund (FOF) route that invest in US based tech companies.

As per SEBI guidelines Sectoral/Thematic Funds are considered under a single category and are required to invest at 80% of its assets in that respective Sector/Theme.

Sectoral Funds

They are capable of providing return that beats Nifty/Sensex when the sector is performing well. At the same time, you need to be mindful of the fact that losses can also be magnifies in case of a sectoral downturn. The bigger risk however is the underperformance of the sectoral funds Vis a Vis the benchmark indices in the periods of consolidation or downward in that particular sector. The reasons for the same are explained in detail below.

Generally, fund houses launch sectoral funds when the going for the industry/sector is good. (Although there are some exceptions). When a sector is doing well it is likely to attract maximum attention of media, fund managers, & investors. So generally it happens that sectoral schemes invest large portions of AUM at the higher end of the cycle. This could be because of NFO or simply investors chasing returns. Now, depending on the longevity of the upcycle the scheme may provide good returns for a couple of years after listing and may outperform the benchmark indices. However, when the cycle turns sideways or downwards, these sectoral schemes are likely to underperform the benchmark for longish periods of time thereby ending up underperforming the Index.

This underperformance can be attributed to two reasons:

- Law of economic cycles, which suggests that period of upcycle are likely to be followed by period of down cycle or at least sideways movement.

- The market operates in a way generally where few handful of sectors which are witnessing growth (in demand or margins or both) are the ones that generally attract bulk of funds. However, these sectors are generally churned every couple of years as news set of sectors show promise while some of the older sectors may consolidate or may start showing de-growth in terms of price movement ultimately impacting the NAV performance.

Therefore it is important for an investor to be mindful of these aspects while investing in sectoral funds.

On the other hand there are some sectors like IT/Tech, Pharma which are generally considered defensive sectors as they cater majorly to export markets and are to that extent de-coupled from the domestic economy. While there are other sectors like metals, energy which are dependent majorly on global prices and then there are sectors that are dependent on performance of the domestic economy like banking and finance or infrastructure and construction related funds.

Thematic Funds

Line of demarcation between Sectors & Thematic funds is often a thin one. Thematic funds on the other hand can invest in multiple sectors and are a lot broader in the scope of investible opportunities. Also themes unlike sectors are not prone to frequent rotations in terms of underlying economic fundamentals or fund flows and are therefore a lot more stable in terms of returns. Themes like Digital or ESG where there is likely to be a long runway in terms of growth opportunities and investor interest are likely to be in vogue for longer periods of time and less susceptible to fund flows. Therefore Thematic Funds are a better choice for investors than pure Sectoral Funds as Thematic Funds are likely to provide stable and sustainable returns over longer period of time as compared to Sectoral Funds.

While there are risk that some of the themes may wither away in course of time but an investor should try and identify themes which have promise over a longer time horizon.

At Investopert, we help our clients make this choice by identifying themes which are likely to do well over a long term.

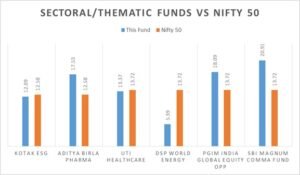

Let’s study performance of some sectoral/thematic funds vis a vis Nifty. This will give us an idea as to how they have performed in the past.

Source: moneycontrol.com | YTD return for Kotak ESG & AB Pharma Fund, 5 Year CAGR for the rest.

While Kotak ESG and AB pharma funds are relatively new, other schemes have performed reasonably well over the past as compared to Benchmark NIFTY returns. Recent rally in steel and commodity stocks has helped SBI Comma Fund to outperform the Nifty. PGIM Global Equity fund is a Fund of Funds that seeks to invest majorly US listed technology and emerging themes.

Taxability

Taxability is same as any other equity oriented scheme unless the scheme is a FOF. Long-term capital gains realised on selling equity fund units after a holding period of one year or more of up to Rs 1 lakh per year are tax-free. Beyond this limit capital gains tax of 10% is applicable. Short-term capital gains realised on selling equity fund units within a holding period of one year are taxed at a flat rate of 15% irrespective of your income tax slab.

To summarize Pros & Cons

Pros

- Thematic funds with positive long term trends can do well over longer periods. Sectoral/Thematic funds can give better returns during phases when the Sector/Themes are doing well – although this is subject to Timing Risks.

- Potential to outperform traditional indices if the theme/sector is doing well.

- Allows you to participate in the uptrend of a particular better performing sector.

Cons/Risks

- Sectoral funds by their very nature do not provide industry wide diversification & hence are naturally prone to higher concentration risk. Meaning, any adverse event affecting a particular industry is likely to have a larger negative impact on its performance.

- Risk of underperformance vis a vis the Nifty/Midcap benchmarks in periods of consolidation/negative growth phase of the sector.

- Investors need to time the entry and exits to generate higher returns – which is not easy and generally prone to judgmental or executional errors.

Recommendations

- Understand the longer term prospects of the themes which you tend to invest.

- Make sure you allocate only 10-20 % of your portfolio to such funds to keep the risk involved under check.

At Investopert, we prefer partial allocation to select themes (Thematic funds) which have good longer term prospects and are therefore likely to perform well over longer term. Sectoral funds being too narrow by structure are best avoided. We have been advising our clients to invest in some of the schemes/funds of funds that invest in Digital, Technology & ESG themes for longer horizons. (For names of schemes & how to invest in them kindly contact us)

Considering the new SEBI guidelines on number of schemes per category and the high levels of investor interest in Equities at the moment, host of new schemes have been launched in this Sectoral/Thematic category and more are expected to be launched by AMCs.